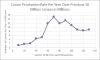

Attached is a graph which permits some comparison with CIPA numbers, though the dates aren't aligned that way. The graph uses Canon's announced EF lens production milestones to estimate lens shipments per year over the intervening time interval, but those are aligned to announcements instead of years. The 130M announcement just came out. The peak at 70M lenses occurred in late 2011.

For comparison, one can roughly align CIPA numbers with the milestones. So Canon produced roughly 8.4M lenses in 2016 give or take a few, and CIPA reports member shipments of 19M, leaving Canon with a 44% market share in lens shipments (among CIPA members).

In 2011, both 60M and 70M production milestones were reported. Using the higher of the two, 15.15M lenses per year, Canon sold approximately 58% of lenses shipped that year of the 26.27M that CIPA reports.

None of this aligns perfectly with profits, of course, since recent shipments by all makers have included large numbers of more expensive lens products with higher profit margins. And Canon's automation of lens manufacturing may also increase their margins.

I note that Nikon reached a Nikkor 60M lens production milestone in the end of March 2011, 70M in June 2012, and so on up to 100M in July 2016. Attached are the lens production estimates for Nikon as well, though again they are not aligned by date.

Using those milestones and the same methodology, I estimate Nikon produced about 7.94M lenses in 2011 for a 30% market share, while shipping about 5.99M lenses in 2016 for a 31.5% market share.

These estimates are unrefined, but do give us data about how the overall lens market is changing. Lenses sold by other manufacturers (probably chiefly Sony/Zeiss and Sigma in the DSLR domain), are taking a larger market share and taking it mostly from Canon. [This is slightly surprising, since it appears that Nikon may have suffered more in camera body sales than Canon over that same period. However, lens manufacturers appear to be targeting Canon since it has the largest share of DSLR camera production.] Some of this may also reflect increasing market diversification into both mirrorless and (more recently) faux medium format offerings by manufacturers.

Canon and Nikon still account for about 75% of all ILC lenses sold according to this data. This is down from 88% in 2011.

Scott

For comparison, one can roughly align CIPA numbers with the milestones. So Canon produced roughly 8.4M lenses in 2016 give or take a few, and CIPA reports member shipments of 19M, leaving Canon with a 44% market share in lens shipments (among CIPA members).

In 2011, both 60M and 70M production milestones were reported. Using the higher of the two, 15.15M lenses per year, Canon sold approximately 58% of lenses shipped that year of the 26.27M that CIPA reports.

None of this aligns perfectly with profits, of course, since recent shipments by all makers have included large numbers of more expensive lens products with higher profit margins. And Canon's automation of lens manufacturing may also increase their margins.

I note that Nikon reached a Nikkor 60M lens production milestone in the end of March 2011, 70M in June 2012, and so on up to 100M in July 2016. Attached are the lens production estimates for Nikon as well, though again they are not aligned by date.

Using those milestones and the same methodology, I estimate Nikon produced about 7.94M lenses in 2011 for a 30% market share, while shipping about 5.99M lenses in 2016 for a 31.5% market share.

These estimates are unrefined, but do give us data about how the overall lens market is changing. Lenses sold by other manufacturers (probably chiefly Sony/Zeiss and Sigma in the DSLR domain), are taking a larger market share and taking it mostly from Canon. [This is slightly surprising, since it appears that Nikon may have suffered more in camera body sales than Canon over that same period. However, lens manufacturers appear to be targeting Canon since it has the largest share of DSLR camera production.] Some of this may also reflect increasing market diversification into both mirrorless and (more recently) faux medium format offerings by manufacturers.

Canon and Nikon still account for about 75% of all ILC lenses sold according to this data. This is down from 88% in 2011.

Scott