Canon's Market Share Spikes in Japan, Threatens to Overtake Sony

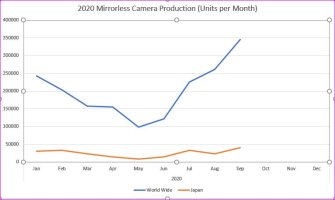

According to a report by BCN, despite a rough start to the year due to the proliferation of the COVID-19 Coronavirus, the camera has begun to recover in

If these numbers are accurate, the trajectory for Sony FF mirrorless market share and Canon's will cross each other within the next month or two, placing Canon as the top FF mirrorless maker in the home market and relegating the once dominant Sony to 2nd place. If this sounds familiar, it is because the overall market share of ILC's including mirrorless and DSLR's are in this order, with Canon at a dominating 45% of overall worldwide share for all of 2019, and Sony at a distant 20% second place.

What is remarkable about Sony's home market share collapse is the speed in which this happened. As recently as June 2018 Sony had a 100% share, and with the entrance of Canon and Nikon, started a steep decline followed by a slow recovery, and now another noticeable decline triggered by the Canon R5/R6 entrance. This has culminated in a new all-time low of 43.9% Sony share, a staggering 56% loss in just over 2 years, and continuing. This precipitous drop in Sony share is in sharp contrast to the pro-Sony headlines that gives an impression of the opposite happening - that Sony is the one dominating. "Sony conquers Canon", "Sony dominates mirrorless markets, and the competition is a long way behind", "Sony overtakes Canon", etc. While market share undulation is normal month-to-month, making headlines based on these undulations in Sony's favor is not only insignificant, it is misleading.

The wide-angle market view shows a more accurate picture of trends and the real deal, so to speak. With the annual aggregate sales of 2019 showing that Canon actually gained more market share (+2.4%) despite its dominant position than its nearest rival Sony (+0.9%), combined with this imminent Canon takeover of the home FF mirrorless market, it is more accurate to worry about the competition's health in keeping Canon vigilant and hungry. It will be interesting to see if Sony can slow down or reverse this trend in the coming months, as pro-Sony aspirations look increasingly obscure and irrelevant.

Last edited: