When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. |

We had been talking for over a year about the Japanese and Asian market retro boom, which is the reason why we are seeing some movement in the companies making integrated lens cameras. Now, before anyone jumps all over me, yes, BCN is Japan only, but the Japanese manufacturers have always given special attention to this market.

This seems to be for a few reasons, as BCN mentions, 1) smartphones are getting boring these days, and 2) the older classical integrated lens cameras didn't have the mountains of image processing done to each image, so it looks almost “film-like” in today's era.

Amusing that we spent 20 years as photographers getting better gear to remove the potential of noise and cleaner images, and here the opposite is a thing.

I have been in Asia now for years, and I've seen this firsthand. Still, it's even worse that BCN makes it out – you can't get anything unless you are willing to sell a kidney or perhaps a mother-in-law that has “canon” written on it. “canon” and an integrated lens camera? Be prepared to live off one kidney and say goodbye to the MIL. G7X Mark II's are selling for more than full-frame ILC cameras, and G7X Mark III's are around 150% more than their original MSRP.

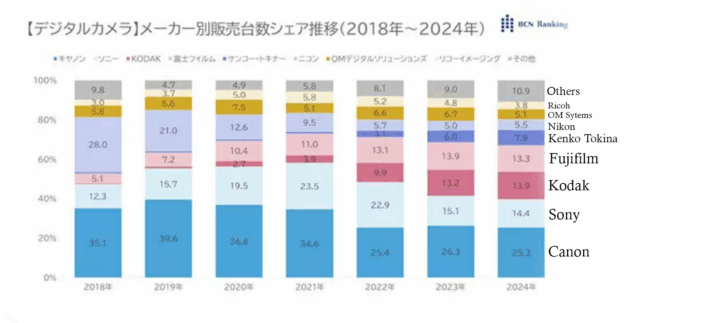

With all this interest in lower-end camera systems, other vendors have risen to the challenge while the big companies were sleeping. Kodak (another branch of the main Eastman Kodak company) is now one of the top-selling camera companies in Japan in terms of units sold. Fujifilm, with its compact and retro-looking cameras, is making a surge in Japan. Suddenly, what was in the past Canon and Nikon fighting it out for top dog, now, it's 3 to 4 vendors having a dark alley knife fight.

Canon has shrunk in the last few years in Japan, but not nearly so much as Nikon, which has all but vanished in Japan. I'm not sure what happened there for Nikon. But something has not resonated with the Japanese purchasing public. Fujifilm, Kodak, and Kenko Tokina have consumed Nikon's share and Canon's declining share. No, this is suddenly not The Onion.

There are a few surprises in that list, such as Kenko Tokina. Kenko, many of you will know it as the teleconverter company. Well, now they are selling more cameras in Japan than Nikon. These cameras get noticed by being reviewed as “is this the worst camera ever made?”, but the people who buy them do not care.

This is a Kenko ultra-lightweight, micro camera, or “toy camera” as it's sometimes marketed as. It shoots both stills and video, takes micro SD cards, and comes in four different colors (naturally). Kenko makes around six other cameras that I doubt any of us have ever heard about (I know I haven't).

Kodak at least looks like some serious-looking integrated lens cameras, with the top-selling Kodak camera in Japan being the FZ55.. Just a 28mm equivalent wide-angle lens, 1/2.3″ 16MP sensor, and a 2.7″ LCD screen. That's all it takes to sell more cameras than Fujifilm in Japan.

Of course, we should mention that this focuses on units, and not revenue. Nikon, Canon, and Sony generate significantly more revenue from camera sales than Kodak and Kenko will ever dream of doing. Still, it is a sign that the bigger companies are overly focused on that revenue versus growing the market.

Just concentrating on the upper end also doesn't serve them any better over time, as the Japanese Audio companies will attest to. I think this year we've started to see the Big Three wake up to what is happening in Japan and will do what some will assume are some puzzling actions to counter this trend. It's ironic because both Canon and Nikon, even on the ILC (interchangeable lens camera), have left the cameras that worked well in this sort of environment. For Nikon, it was the one series of cameras, for Canon, the EOS-Ms. Sony has re-entered the small camera market with great success. The price doesn't seem to matter as the smaller ZV-E10s continue to sell exceptionally well. Canon is hoping to recapture the same thing with the EOS-R50V.

- For Content Creators and Vloggers

- 24.2MP APS-C CMOS Sensor

- DIGIC X Image Processor

- UHD 4K60p Cropped, 4K30 6K Oversampled

- Dual Pixel CMOS AF II

- 3.0" 1.04m-Dot Vari-Angle Touchscreen

- Close-Up Demo, Smooth Skin Modes

- Vertical Mount, Front Record Button

- Multi-Function Shoe, Wi-Fi & Bluetooth

- 4 Live Stream Modes, Canon Log 3

However, I still think these larger APS-C and full-frame cameras are missing the mark. BCN suggests as much:

Low-cost integrated lens cameras not only take photos that cannot be captured with smartphones, but also have a compact size and affordable price range, making them easy for young people to pick up. It could be said that how manufacturers leverage these appealing features to acquire new users is a key factor in determining their market share.

New users are essential; you aren't going to grow your market share by selling to the same people repeatedly each year.

There's an Elephant in the Room

We briefly discussed China in both the CIPA data and our latest article about Laowa. But what we haven't talked about is the millions of cameras, like Kenko and Kodak, that are being sold in China. Don't believe me? Just pop over to AliExpress and have a look.

Are these cameras any good? Of course not, but neither are those Kodak and Kenko cameras. There are so many and such a variety, and so cheap that I even want to buy a few to check them out. If the Japanese major camera companies sleep at the wheel on what is trending in Japan and Asia, Chinese camera companies may flip the script entirely. They are already threatening, as DJI has already purchased Hasselblad.

China is currently the largest market for Japanese cameras, so falling behind in this market may be disastrous for the Japanese camera companies, especially now that the USA is taking action with tariffs.

Closing Thoughts – and what About Canon?

For all my griping, I think Canon, for the most part, is shifting directions with the V series of smaller cameras, such as the R50V mentioned above. But it's still a big camera, with a big sensor. The amusing thing is that part of the market doesn't want either. A return to the small-sensored Powershots with classical looks would be panned by photographers, but snapped up by those who currently buy the Kodaks and Kenkos of the world. The IVY platform may be the way into that market. Why is it important? It keeps you relevant with different market segments. We grew up hearing all about Canon and Nikon. The younger generation? Not so much – and for Canon, it's even worse. I see that writing here, most of the news is Sony mount related (third-party lenses, etc), and even Craig said to me lately, he's tired of seeing everything about Sony. Canon's closing off the RF mount to third-party lenses for the most part has limited the news that mentions “Canon” to fringe news items.

Would I buy a small PowerShot from Canon? Absolutely. My Canon Elph-180 is a Kolari converted Pocket and I'm using it until it falls apart, which may be soon! The LCD doesn't work quite right anymore, and it makes strange noises – I think it's on its last legs. It does things my smartphone cannot, and when I want to take out something small and inconspicuous, it fits the bill – and of course, now I'm with the cool kids for doing so.

Maybe some people just wish to have some fun making photos - without having to listen to the endless stream of youtubers and influencers telling them what to do.

The R50V is for Vloggers - a totally diffrent market segments. People who think they could make some money with their video, and are going to spend on their gear.

Canon for some reasons looks to despise its root in the viewfinder cameras (because back then it wasn't the top dog, with Nikon and Topcon above them?), so looks unable to deliver something alike. Maybe market data are on their side (Fuji thinks different, anyway), but it's a lot less fun...