|

When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. |

There are two notables from CIPA 2024 statistics, and I think both are curious, but for far different reasons.

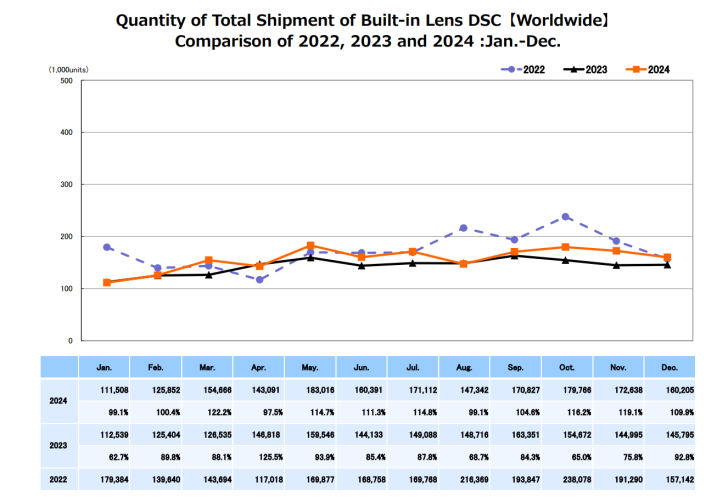

First, let's talk about compact cameras. Even though most compacts being bought and sold these days are used, even new compacts last year showed a 31% increase in shipment value and 9% units shipped from 2023. Japan has led the way in this regard, with a 12% increase in compact cameras shipped in 2024.

The second curious point is the rise of China as the leading export destination of Japan's cameras. The Chinese shipments amounted to 29% of all mirrorless cameras shipped and were 35% more than the Americas market in units and 43% more in total value. This may be curious as both Nikon and Canon may be handcuffed on exporting their high-end lithography technology to China and having to cater to that same market for cameras.

Canon is bullish on its lithography sales for 2024, but they didn't necessarily mention where those sales were going; it's most likely safe to assume that Canon had China in its sights.

According to the Japan Times, the Japanese government wants to control export items further.

The central government is expanding its list of export-controlled items to include advanced chips, lithography equipment and cryocoolers needed for the manufacture of quantum computers, according to draft revisions to the foreign exchange law.

If Japan's new restrictions impact Canon, Nikon, and even potentially Sony, it could lead to their taking a significant hit in the Chinese camera market. Chinese consumers have become more nationalistic when faced with export controls and sanctions.

Compact Cameras

Compact cameras showed remarkable growth in 2024, basically when everyone wrote them off as dead. They showed growth even though no one released a compact camera outside of Fujifilm in 2024.

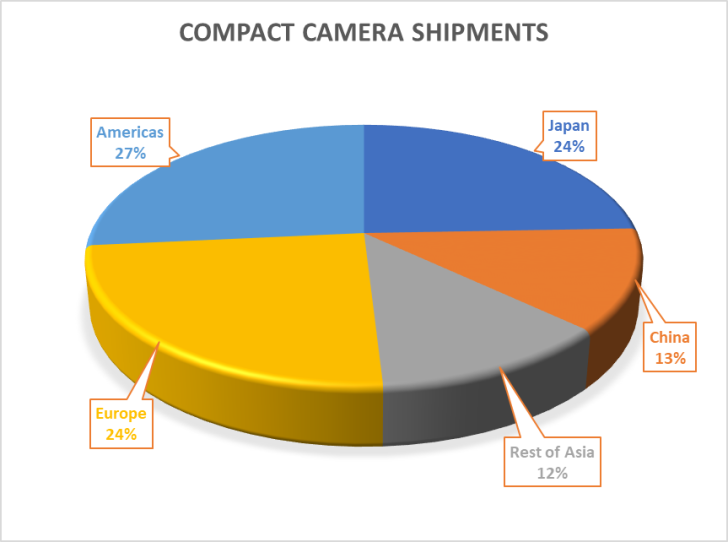

The regional split for compacts is different than I thought it would be. The Americas and Europe import over 51% of all compact cameras for the overall compact camera market. Still, the notable one is Japan, which imports 24% of the overall market, which makes it astoundingly larger than other markets if you consider this on a per capita basis.

There seems to be less interest in compact cameras in Asia than expected, but I'm wondering if this has more to do with the fact that there aren't any new ones. This is why you will see Nikon, Canon and, most likely, Sony respond to this oversight this year. By this time next year, I would expect the compact camera shares to change and Asia to have the majority. Small cameras are good to have over here.

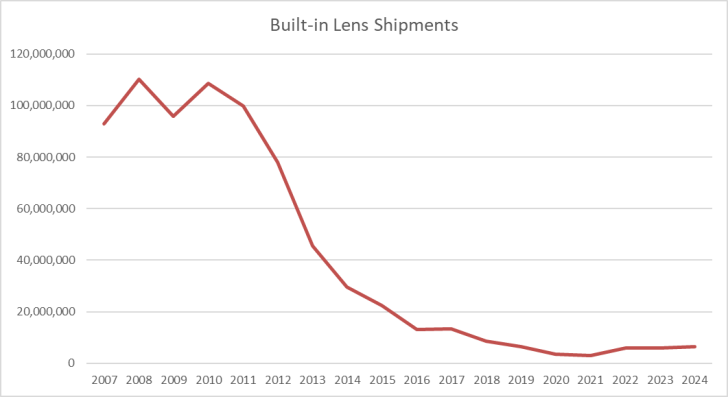

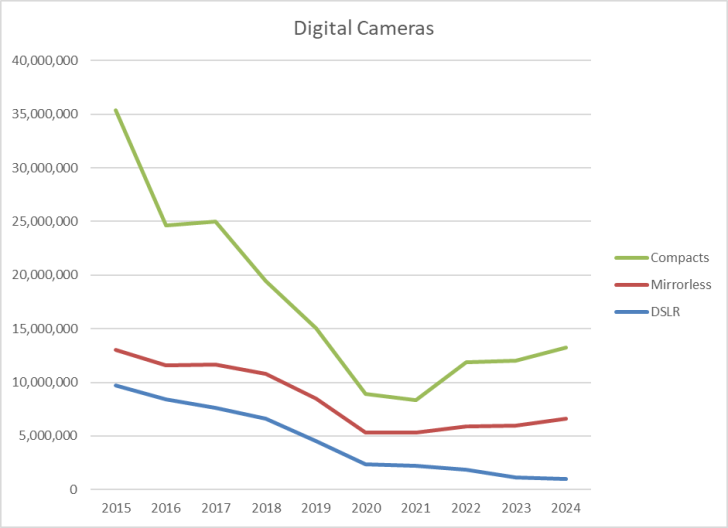

If we look at history, of course, this still looks like a significant bloodletting from its peaks in the past.

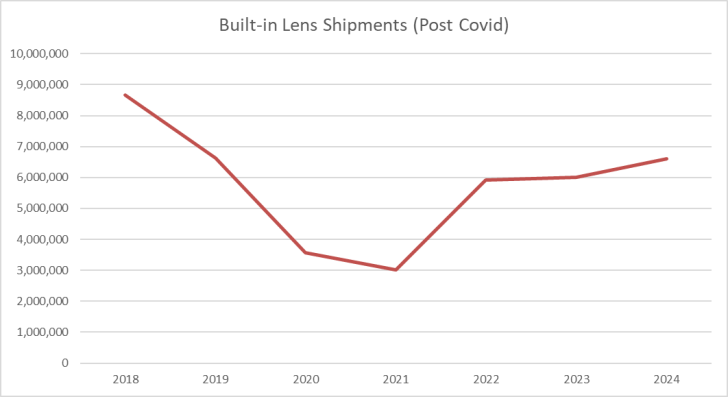

But this is a little unfair because, while depressing, it doesn't show us where we are heading now.

The market started to recover from COVID-19 in 2022, and it's been on an increasing trajectory for the last 3 years and is on pace to recover to the pre-COVID 2018 volumes, which no one would have expected. Yes, it's slow, but it's grown with Canon releasing a compact camera in 2019, Nikon in 2020, and Sony in 2023. From the big three manufacturers, only seven compact cameras were released. Canon used to put out over seven per year.

Interchangeable lens cameras (ILC)

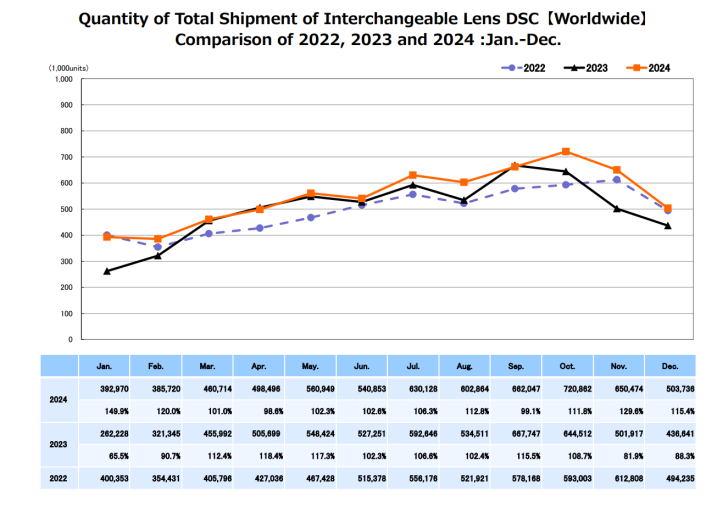

For interchangeable lens cameras (ILC), the market showed a solid jump in overall shipments, with 10% gains from 2023 by units and 13% by volume. Mirrorless cameras continue to sell exceptionally well, and the adaptation of mirrorless cameras continues to grow. Mirrorless camera shipments grew 16% in the year by units and by value.

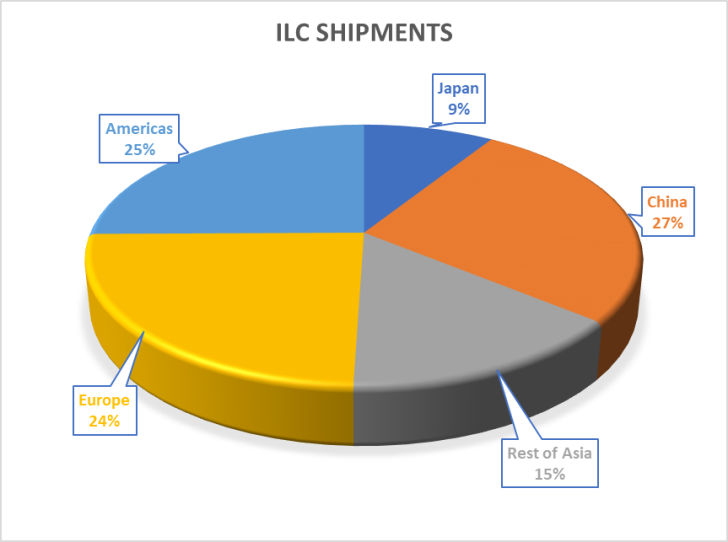

Overall, ILC China has a slight lead over other regions, with 27% of the total market, while the Americas are next at 25%. Asian countries, on the whole, had over 50% of the shipments in ILCs

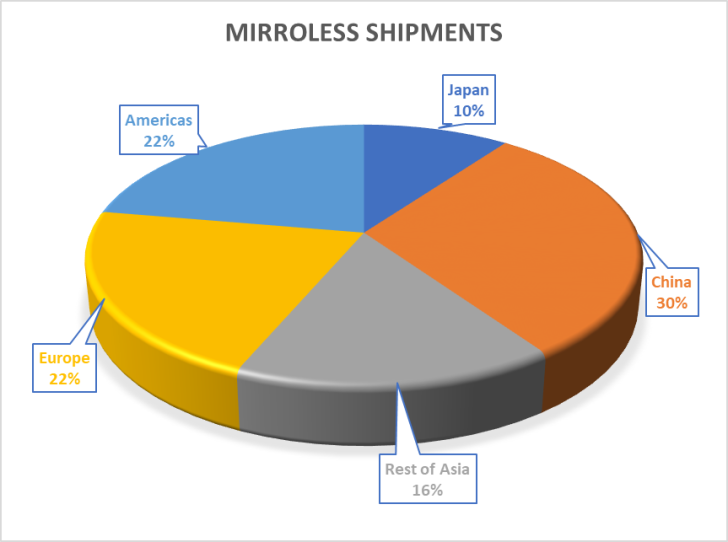

As mentioned, this changes quite a bit if we look at mirrorless cameras. Part of the reason seems to be that China doesn't want any DSLRs, while 4 times the number of DSLRs get shipped to Europe and the Americas.

If we look at mirrorless, Asia held a 56% of the market share on shipments in 2024.

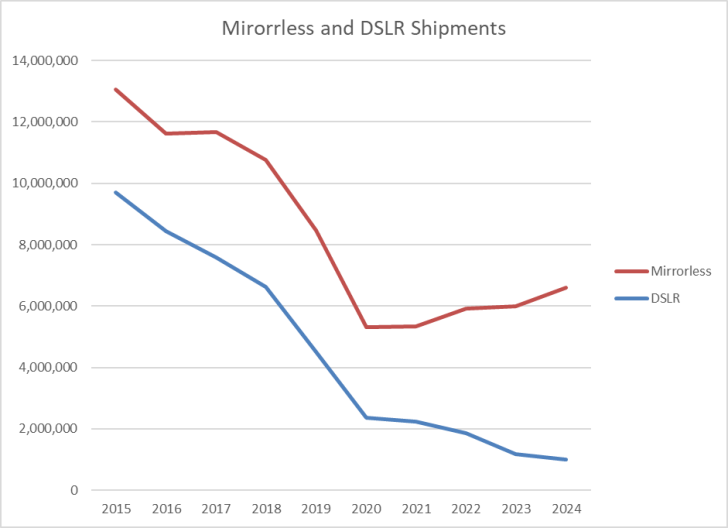

I decided to look back at the last 10 years to see how the overall market seems to be doing; I could have gone further, but like with compact cameras, I think that ends up losing the current trends.

Now it could very well be that if we look at the market from, say, 2005 and trended that line downwards, we could have a different and more bleak narrative, but I think it's interesting that we are seeing the market respond after the crippling blows of COVID. As long as the line continues to trend upward, there won't be many complaints from the Japanese camera companies.

A final pretty graph shows that the entire DSC (Digital Still Camera) market does seem to be responding in good order after COVID-19, and I will be curious to see how many more compacts will sell this year.

Now, imagine how many more mirrorless cameras would have sold if the R100 was a better camera ;)

Source: CIPA

For me , that's not an odd choice. In China, it's only need 400$ to buy a R100 body while the R50 costs approximately $550. For reference, young graduates who might be interested in photography typically have an estimated monthly income between $700 and $1,500.

I do however, still think Canon could do a better job on the R200.

Good kit lenses are no longer needed - thanks to Sigma 😉

I had to! y'all would have been disappointed if I didn't go there 😉

coming from the M's i thought i would find the R50 fine to use - I absolutely hated it. I had no problems with the M's (any of them) but i was constantly causing button clicks holding the camera by pressing against the circular button pad

that little bit of difference made me rage a bazilion times. even the R10 really doesn't have space between the edge of the camera and the wheel.

My small travel body was a 200D/SL2.

I never had issues. So I think the R50 ergonomics should work for me, too.

To me, they look much more similiar than the M‘s do.

there's still a bit more of a gap, i'd try it out and see if you like it or not, it's obviously one of those subjective things where everyone is different.

Or with the just rumored R50V…

The R50V sounds curious.

A lot of the increase in "compact" cameras is the the Fuji X100V. However this IS NOT a compact camera. CIPA doesn't track "compact" cameras they track "fixed lens" cameras. People are using these categories interchangeably, but that is incorrect. The Fuji X100VI is an apsc camera with a fixed lens.

iF Canon sold a version of the R7 with a fixed lens and it sold well, it would show up in CIPA's "fixed lens" category and people here would be saying "wow compact cameras are doing great". But clearly the R7 isn't a compact camera.

Here is the "compact" Fuji X100VI which is leading the craze vs the Sony A7C which is FULL FRAME:

Venus/Laowa/Meike/ etc are making lenses and Huawei is moving away from Sony for camera sensors so at some point in time they have the bits to put together.

If there is a substantial domestic (meaning within China) market for compact cameras combined with increased tariffs and nationalism then it may be sooner rather than later. Hauwei would make sense to be the OEM and use their existing distribution channels. If they can improve the camera-to-phone/internet connectivity transfers within China then they would have a winner IMHO.

The Instax market would also be vulnerable as well.

Canon/Sony/Nikon will still have the higher end ILC market to themselves for the foreseeable future though.

Unless there is a major disruptor product (eg deepseek), catching up will be a difficult and expensive proposition.

The alternative is what Sony did with their Konica Minolta acquisition similar to Geely/Volvo and SAIC/MG etc assuming regulatory approvals

https://www.yahoo.com/tech/dji-osmo-pocket-3-japans-160602981.html

So while its crushing the competition in Japan because its not made in Japan and therfore not a part of CIPA were just going to act like it doesn't exist I guess.

I beleive DJI aleardy has this. The Mimo app is generations ahead of anything I've seen on a mirrorless cameras.

On the high end they have Hasselblad and in the cinema space they have Ronin. But I agree these are more niche and the big 3 will dominate for years to come.

that's a very good point. if the market keeps going and China keeps ticking at around 4-5% growth, sooner or later, it'll happen.

I guess DJI would be one that I could see sooner rather than later. They are almost there anyway. There have been rumours of DJI jumping into that market and patents to show they are working on something.

Hauwei would be incredible if they had a tight integration with their ecosystem (which they probably would for obvious reasons)

To be honest, I'd love to see what Huawei could do. Their ecosystem integration between their devices is insanely slick - this may be far more of a possibility now that they have done their own image sensors for their phones. if you can manage a phone image sensor of good enough quality scaling that up to at least APS-C isn't much of a problem.

This was very much a Samsung problem too. There's also a strong bias to Japanese camera manufacturers. it's hard for a Korean or Chinese to break into the market. Of course Chinese brands though would have a pretty strong chance of dominating the domestic market in short order especially if it was a reliable brand like DJI or Huawei

The issue I see is that DJI has already broke into the market. BCN put out the best selling cameras of 2024 witht he ZV-E10 and the R50 being #1 and #2. The OP3 is in a differenct "category" crushing the compettion at 24.3% market share and the Hero 13 black in second place with only 9.1%.

However the OP3 is a vlogging camera that competes directly with the ZV-E10 and R50 and not with the Here 13 black which is an action camera. On Amazon the ZV-E10 and R50 are selling about 550 a month each. Meanwhile the OP3 is selling 9,000 a month.

So DJI already has a model that is dominating in America and because their numbers aren't tracked by CIPA everyone just pretends it doesn't exist.

The thing about Osmo and drones is that they are primarily video and secondarily stills. That isn't a blocking issue but it is a different space and clearly MILCs are closer to video (EVF/AF) even though stills are the primary feature.

Yes, DJI (or GoPro for that matter) could put together a compact camera/fixed lens and it would be an interesting to see what they could do with it.

DJI has a majority stake in hasselblad so there's got to be some good synergy there as well