When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works. |

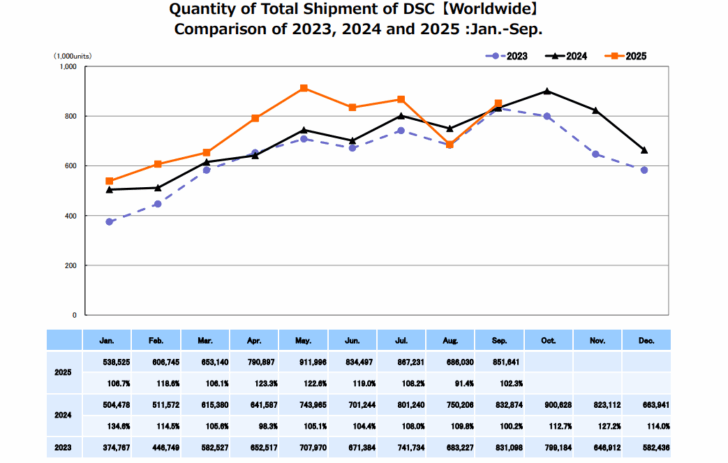

In a tariff-defying month, CIPA has reported that the sales for September 2025 have actually increased from September 2024. The numbers are slight, with September having 851,641 units shipped while September 2024 had 832874. However, in the tariff times, any increase is welcomed for the Camera Industry.

Overall, the camera market in terms of Cameras with interchangeable lenses has shown a 6.7% increase over 2025, and mirrorless in particular has shown a 12.8% increase. Cameras with built-in lenses have also shown an impressive year-to-date increase in sales, with a 17.1% increase from 2024.

CIPA Camera Market – The Chinese Market

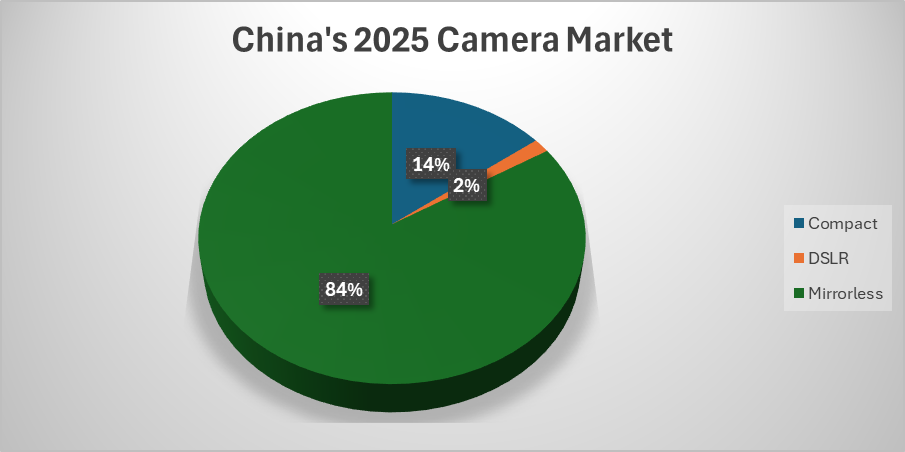

More interchangeable lens cameras were shipped to China than any other region; this is true for both the month of September and also the year-to-date for 2025. What I find most interesting in China is a sudden interest in cameras with built-in lenses, or compact cameras, where the shipments have jumped up 48% year to date, and 17% in the month of September.

There’s one that China does not like, and that’s DSLRs – it’s new technology or nothing when it comes to the Chinese market. This behavior matches up with Japan as well, where the vast majority of cameras shipped into Japan are mirrorless or compact cameras, and not DSLRs.

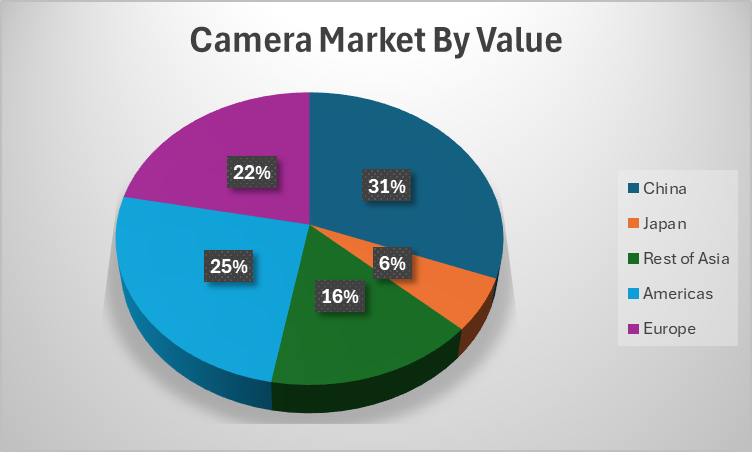

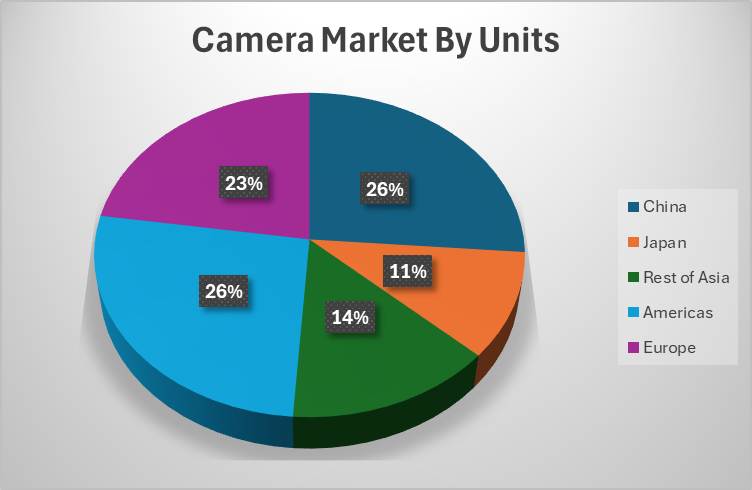

I find it interesting how quickly the Chinese market has begun to dominate the overall camera market. There was a time when China wasn’t even split out into its own region for CIPA, and now, it’s by far the #1 region in the world for both camera shipments by units and also by value.

If we look at the unit share, though, we see that the Americas has about a 1071 unit lead over China if we look at the entire market, including compact cameras. The Americas get shipped almost double the amount of compact than China. It’s most likely also why China has a larger amount of value shipped, as they don’t have as many low-value compact cameras being imported into the country.

So what does all this mean? Probably nothing in the short term, as the Japanese camera manufacturers have to adapt to making more asian cameras than Western, but they are doing that already.

CIPA Camera Market – Asian Markets

The asian market overall is over 50% of the camera market, by value and also by units. When I’m walking around and looking at the photographers using mirrorless cameras here in Vietnam, Canon dominates, and it’s not even close. Any used Canon camera, even a DSLR, is vastly marked up far more than its Nikon or Sony cousins. So for Canon, I wouldn’t be surprised if they continue to look to exploit the Asian markets as much as possible. That includes giving cameras a priority for weight and size, as that’s incredibly important over here in Asia.

As far as what the Chinese prefer, I’m not sure. They have a far different infrastructure in China versus the region I’m in, which is the region of “other Asian countries not including Japan and China”. This could also be a problem for the Japanese companies if they fail to understand what the Chinese want in their cameras in terms of features and interoperability. If the cameras are not flexible or connected well enough, someone such as Redmi or Xiaomi will certainly be coming out with their own. A sudden loss of the Chinese market would be very hard for the Japanese manufacturers to handle.

CIPA Camera Market – The Americas and Europe Markets

If we combine these two and call it the “western nations”, both by value and also by units, the western nations are slightly under 50% of the entire market. These are obviously very important markets for the camera manufacturers, but the Japanese companies have a long history of providing cameras to these markets. So I know we could say the same thing for the Americas or Europe as we did for China, but the camera manufacturers have dealt with those markets for a long period of time, and those markets are fairly stable in terms of customer requirements and demands.

While Europe seems to be strict on carry-on weight, the Americas are less so. This is probably why they have seen the slowest decline of DSLR shipments than any other region. Year on Year, the Americas shipped in 89.5% of the DSLR volume in 2024. As a comparison, Japan is 41%.

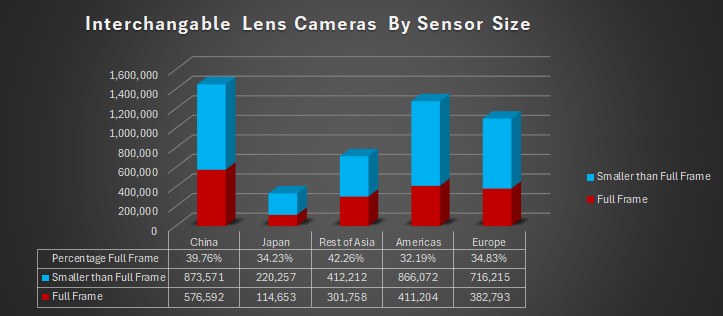

There seems to be a slight difference in the cameras themselves by sensor type that get shipped to Asia and China, with a higher percentage of full-frame cameras going into those regions. Americas, Europe, and Japan are fairly consistent, with around 32-34% of the cameras shipped being full frame, while China and the rest of Asia are 40% and 42% respectively. So it appears, anyway, as if the product mix is also a bit different for the camera companies.

Closing Thoughts

The Japanese camera market is continuing to have a good year, even when faced with adversity and declining sales around the world. Canon’s R6 Mark III, hitting the shelves this month, will certainly boost sales in the upcoming months for CIPA.

Sony, as well, is expected to launch a new camera before the year’s end, but it’s unknown if the camera will ship before the end of the year.

Overall, the industry, according to this CIPA report, bodes well, and we may actually see a real increase in the cameras shipped this year.

0 comments