When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. |

I have been away from this for a few months, and here we are now in the June 2025 CIPA reporting cycle. For those unaware, CIPA reports on all production and shipments of Cameras from Japanese vendors.

Looking at the data, we see that the vendors have shipped far more camera systems so far in 2025, but it’s hard to tell if they are trying to beat tariffs, currency changes, or getting as much out the door as quickly as possible.

China? Again?

When I first saw this graph, I assumed that the majority of the increase was going to the United States to beat the tariff increases. But it wasn’t, as most of the increase was going to China.

So this is an interesting development, as it wouldn’t make sense to ship the cameras to China to turn around and ship them to the USA to get around tariffs, so there must be simply an increasing demand for cameras in China that has continued from 2 years ago and is still maintaining impressive growth today.

As it stands, China is now the dominant region for ILC (interchangeable lens cameras), and it should be noted that outside of the numbers for Japan, China is the only region that is a singular country. For instance, the Americas include all of South, Central and North America – and while the USA most likely dominates the shipments, it’s not the only country that receives cameras in the Americas.

I think this will be interesting to watch over the next year to 2 years and see how the Chinese, American and European markets settle out in terms of camera shipments. The tariffs are going to complicate life for the camera companies, not only in terms of logistics and paying the actual tariffs, but also in calculating the rate at any given point in time, with the rates changing on a whim – or a tweet. This is assuming they are even legal, but we won’t go down that rabbit hole. Let’s say the entire thing is a mess, and I can’t imagine being a company like Canon, Sony or Nikon trying to deal with it.

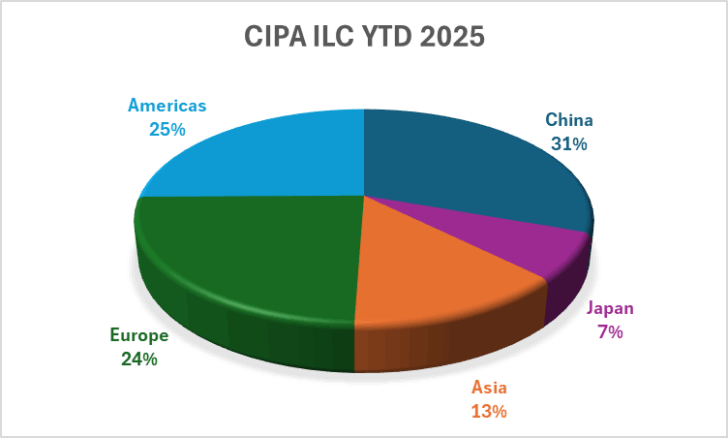

CIPA ILC Regional Market Share

Let’s get into the dirty details of the numbers now. First, let’s look at where we are in terms of year-to-date for the CIPA regions.

As we mentioned, China holds a commanding 31% of the shipments for all ILCs (interchangeable lens cameras) in 2025, up until the end of June. Out of curiosity, I looked back to June 2022 to see what it looked like per year from January through July for each year. There wasn’t much point in looking back before 2022 because of a little thing that happened in 2020.

When we compare by year, we start to really see how the regional dynamic has changed in even four short years.

The Compact or Built-In Lens Camera Market

The in-lens camera market, again, looks odd, with Japan for some reason receiving a far greater share of these cameras than we do see ILCs. As I mentioned last year, the companies are going to wake up and start releasing new built-in lens cameras, and the PowerShot V1 now says hello.

This is why we report on CIPA, at times we can see trends before we start seeing the camera companies publicly react.

We can see that China, in this case, has an aversion to built-in lens cameras – I have a feeling this is for two reasons;

- There isn't the retro “compact camera” craze happening in China

- They have tons of vendors that do make small sensor built-in lens cameras already that aren't included in CIPA.

As we have noted all last year, something odd is happening in Japan, and it's still happening now. I expect we'll see far more compact and smaller built in cameras in the future as the camera companies attempt to profit over what is happening in the domestic market.

Conclusion

In terms of the overall market, it looks great, but I’m not sure why. It could be that China is such an untapped market with a growing base of consumers that the camera companies have little competition. It could also very well be that the camera companies have increased production and dumped as much as possible in every region, so they have cost certainty. We will find out as the year goes on.

I suspect that we really need to see all the way until September to get a handle on what is happening with the camera companies and the wildly changing global trade environment that we seem to be in.

Usually, as readers know, I tend to dig into the CIPA data for the month with great zeal, but I think this year is different than the others, and while the numbers look great right now, they could fall off a cliff next month, or the month after. There’s such a great deal of uncertainty in global grade right now.

That all being said, with China being such a growth market, it will be interesting to see what the Japanese camera companies will do to take advantage of that.

-Canon financial document