When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. |

Nikon recently released their Q3 financials, and unlike the relatively cheery and optimistic financials from Canon, Nikon's didn't look so good if you look at the company overall.

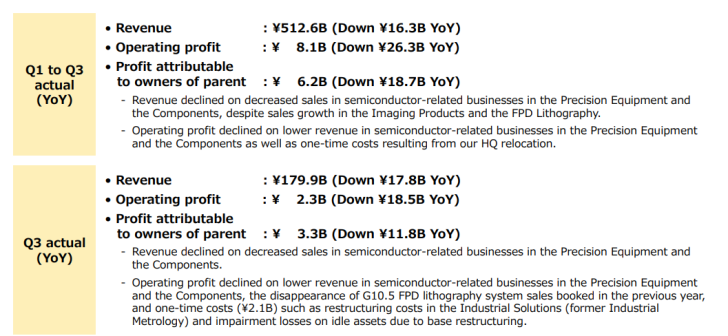

This sums up the current Q3 results.

Everything's down for Nikon corporate. Revenue and Operating profit are both down when compared against 2023's Q3 performance, but perhaps more worrying is the fact that the entire 2024 Q1 through Q3 is down when compared to 2023. Nikon's precision instruments and lithography components business suffered the most, while Nikon's imaging did post modest gains.

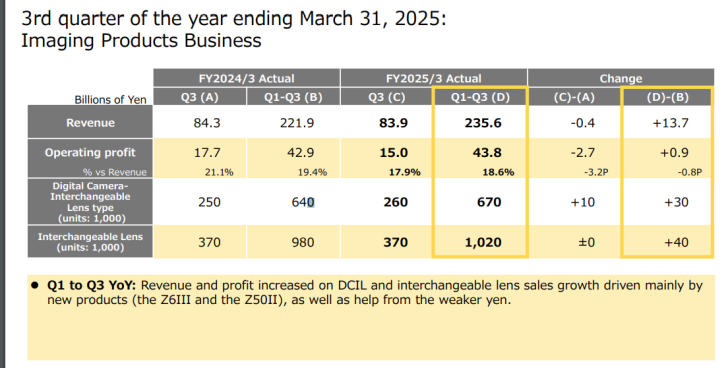

The imaging department sold 10,000 more units for the quarter compared to 2023. I should note that this period, from September through December, is usually when the camera companies enjoy the most sales. Nikon went at that quarter with all guns blazing.

In October, Nikon released the Z6 II, which is a serious prosumer camera body in the under $2000 bracket. Featuring a unique and fast sensor and excellent ergonomics. Most of the sales charts that I've been monitoring have had this camera selling very well.

Nikon followed that up with the Z50 II consumer camera in November. Featuring a compact form factor and a sub $1000 price tag, this camera has sold quite well and features excellent ergonomics and features for its price class.

Both of these are high-volume cameras that, from all appearances, sold very well for Nikon over the holiday season.

So, the 10,000 unit gain sounds good, but the shipments for the industry grew by nearly 300,000 in that time frame. While units shipped do not perfectly align with sold units, it's safe to estimate that the market grew in the fourth quarter of last year. Even Canon, which struggled a bit, increased its sales by 43,000 in the same quarter year on year. Canon also increased its imaging operating profit by 55%, while Nikon reduced its imaging operating profit by 3%.

While I do not think that Nikon is doomed, even though I want to make a t-shirt with that, just because – this is going to put more pressure on Nikon's RED and Z lineup to keep the company moving in the right direction, and it's always more difficult when all your eggs are in one basket in terms of where you get the majority of your revenue. For Nikon, imaging made up 45% of their revenue for the 3 quarters of 2024. For Canon, that number was 20%.

Nikon does have some high hopes for RED, and it's unclear about how much of Nikon's revenue is made up of RED revenue versus Nikon's normal camera line, it doesn't sound like it would move the needle that much if Nikon's other business lines don't buckle up and start delivering.

Nikon RED is rumoured to be coming out with a Z mount variant, even though Nikon has exactly zero cinema lenses right now. So even that messaging right now is a bit mixed.

A Nikon 28-135mm F4 PZ is coming out shortly (or maybe even by the time you read this), but it's not an actual cinema lens, either. I can't see many people purchasing a $30,000 V-Raptor cinema camera and slapping a $2,000 prosumer / professional stills zoom on it.

I honestly like Nikon, and I would have been using a Nikon camera if it hadn't been for Canon, as my professional friends had Nikon gear when I started photography. I hope Nikon grows its business lines and increases its revenue diversification throughout 2025.

Sources:

Nikkor 28-135mm image and information – Nikon Rumors

Nikon Financials