|

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works. |

The annual BCN awards are out. These awards are based on Japanese retail sales data. There are winners and losers, and perhaps the most interesting is that Kodak is the #1 compact camera retailer in the Japanese Market, so while the title was a little tongue-in-cheek, you’ll have to read down a lot further to see my thoughts on that. First up, though, some background information.

What is BCN?

For those new to the site, or my own blatherings, the BCN awards are done by a company called BCN in Japan. They tally up the sales data from around 50-60% of all Japanese retailers, and produce market analysis reports, which in turn they sell to companies. But they also publicly publish data on the Japanese market, so we all get to read and share.

Now granted alot of readers aren’t from Asia, but the Japanese market is the largest per capita camera market in the world, and it’s also the home turf to the major camera manufacturers. It’s bragging rights and a sense of pride for the companies to do well in the Japanese marketplace.

DSLR Market

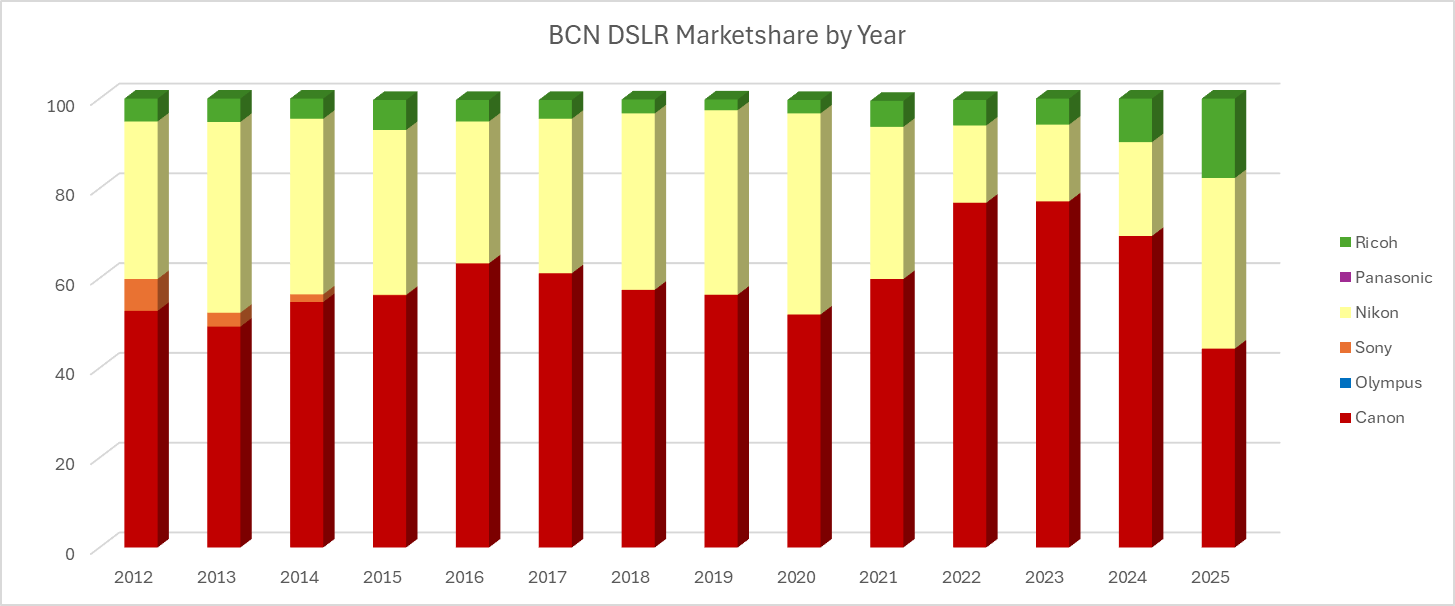

Canon’s share of the DSLR market shrank dramatically last year, as, surprisingly, Nikon and Ricoh’s share dramatically increased. I would put this down to Canon simply not selling DSLRs versus Nikon or Ricoh doing anything special. This is a market that is rapidly disappearing from view, as Japan barely shipped over 1,200 DSLRs per month domestically. While we won’t have the full shipment numbers for Japan from January through November, only 13,357 units were shipped. This is compared to 410,792 mirrorless units. Japan was the first region to adopt mirrorless, and that trend continues.

For this year’s statistics, in 1st to 3rd place are the usual suspects;

- Canon 44.3%

- Nikon 38%

- Ricoh 17.7%

If you sat there with a calculator, you’d quickly see that that accounts for 100% of all DSLR volume because no one else is making them (looking at you, Sony).

This is really a market that neither Canon nor the other vendors care about for the local domestic market. The main markets for DSLR cameras are still the European and American regions. The DLSR cameras that get shipped to these regions are typically the lower-cost camera bodies, as we’ll discuss once the annual CIPA data is released in February.

Mirrorless Market

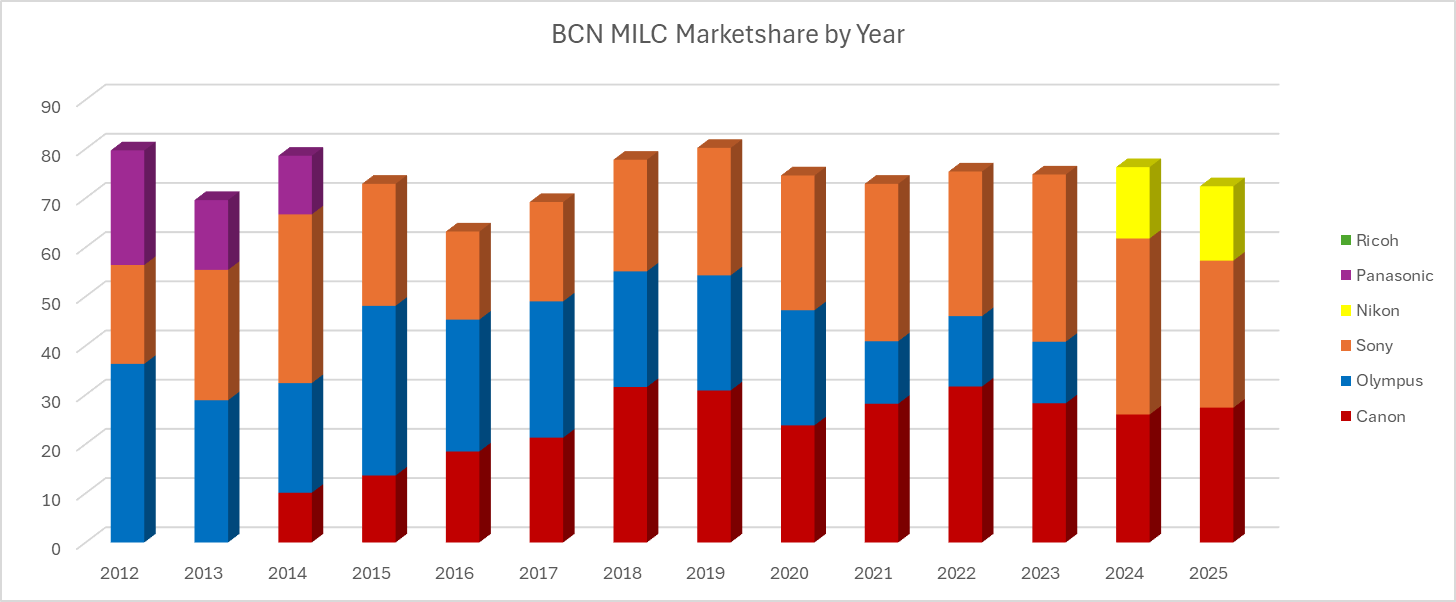

The Mirrorless market from 2014 through 2023 was dominated by three major manufacturers: Canon, Sony, and Olympus. Canon, leading up to 2019 on the backs of the EOS-M system, drove to number one in the market, supplanting Sony as the dominant mirrorless manufacturer in Japan.

Since the EOS-M was replaced with the RF system and full-frame cameras, it’s been more back and forth between the two manufacturers, but Sony over the last 3 years has consistently held the #1 spot in the Japanese domestic marketplace. Perhaps importantly, Sony’s lead over Canon has dramatically shrunk to only 2.5% as both Canon and Nikon have made inroads into Sony’s market share.

While Canon had the best-selling camera in 2025, according to BCN, Sony had far more cameras in the top ten, which allowed it to keep its crown.

Perhaps just as important to those not in the top 3 is that this is the lowest total percentage of the market that the top three have held since 2017 (72.4% for 2025). We do know that Fujifilm has done well this last year in terms of sales, so it’s probably a very good guess that it’s primarily Fujifilm that is eating into that market share.

Nikon continues to grow it’s marketshare – which I think personally is great. Nikon, before 2024, had never placed in the top 3 of Mirrorless manufacturers, but broke out in 2024. They have followed that with an increase from 14.5% in 2024 to 15.1% share in 2025.

Nikon has released some really great cameras, I mean, I did give it the top award for 2025 after all (and no, I don’t own Nikon gear – I was actually accused of that).

Canon also gained last year, with a 5% growth year on year in terms of market share from 26% to 27.4%. But while that sounds good, that’s still quite a bit lower than the heady days when Canon had over 30% of the market in Japan. Canon still has some work to do. Namely, the anchor (or door stop) called the EOS R100.

All in all, it seems that other vendors have grown their market share (including those outside of the top 3) at the expense of Sony. That’s always something I can get behind.

So what about Kodak?

Kodak is the #1 retailer of integrated lens cameras in Japan. Their 24% marketshare is the highest market share since 2021. Kodak, in years past, was fighting it out with Canon for #1 in the market, and this year. BCN has noted that the Kodak Pixpro ZZ55 has been Kodak’s dominant seller in Japan.

This year, the top 3 were a complete surprise.

- Kodak – 24%

- Fujifilm – 13.9%

- Kenko Tokina – 13.5%

Fujifilm’s placing second is their best showing, but they lost market share in doing so as they went from 15% in 2024 to 13.9% this year. Kenko and Kodak primarily sell inexpensive “fun” cameras on the marketplaces, as does Fujifilm as well, via their Instax camera line, but Fujifilm has the hugely popular X100 series as well.

Canon – Simply Gone

Canon has completely collapsed in this market. Now, to be fair to Canon, its Elph release was a disaster – so much so, we gave it our worst of 2025, ahem, “award”.

A big part of Canon’s woes this year could possibly be attributed to the fact that they just simply couldn’t manufacture the one camera that everyone wanted, and that was the PowerShot G7x Mark IIIhot G7X Mark III. The prices for G7X Mark III’s out here in Asia were wild last year, with the retail price going for 150 to 200% more than the camera was originally sold for.

My own pet theory is one of two things: either that Canon ran out of the Digic 8 processors or that whoever was developing the 1″ sensor for that camera stopped doing so, and Canon had to create another supply chain for the sensor. But really, we’re just making excuses for Canon, and they are big enough not to have to make excuses for them.

The BCN awards have been presented since 2005, and since that time, Canon has never placed lower than second in integrated lens cameras, and only twice has it not placed in the top position. This was the first year that Canon completely missed the top 3 since BCN began presenting these awards.

I expect some major movement by Canon in this front this year, maybe we’ll even get a new camera, versus a rebrand.

DJI Dominates Video Cameras

The market leaders in terms of video cameras haven’t changed much in the last 2 years, as DJI, Panasonic, and Sony close out the top three companies for video cameras. What was a surprise is the absolute dominance of DJI, holding down now 64.7% of the market, up from 48.1% in 2024. DJI has grown it’s marketshare from 11.2% in the top 3 in 2021, to where it is now. It’s an impressive showing by DJI. This has been led by the DJI Osmo Pocket lineup, which has consistently placed in the top sellers in Japan. It should be noted that this is not an inexpensive camera either, retailing originally for around $800.

Camera Lenses

For the second year in a row, Tamron has led the camera lens market share, this year, with 23% of the market, while Sigma and Sony continue to place second and third overall.

- Tamron – 23%

- Sigma – 17.8%

- Sony – 13.1%

I don’t usually report on this because it’s a highly fragmented and competitive part of the market, moreso than the other categories, as the top 3 only account for 53.9% of the total sales volume. But Canon, definitely below that 13.1%, which should be a concern for Canon, considering how closed the RF mount is.

Closing Thoughts

This year shows increased competition all around in those segments that matter, which is a good thing as competition fuels innovation, and we all benefit from that.

If I had to guess, from prior comments from Canon regarding market share, that someone inside of Canon won’t be happy for slipping down to 4th or lower on integrated lens digital cameras. I would not be surprised if this gets Canon motivated to do something good for us in this market.

The Mirrorless market from 2014 through 2023 was dominated by three major manufacturers: Canon, Sony, and Olympus. Canon, leading up to 2019 on the backs of the EOS-M system, drove to number one in the market, supplanting Sony as the dominant mirrorless manufacturer in Japan."

...and this as well (again, from the piece):

Canon – Simply Gone

Canon has completely collapsed in this market. Now, to be fair to Canon, its Elph release was a disaster – so much so, we gave it our worst of 2025, ahem, “award”.

A big part of Canon’s woes this year could possibly be attributed to the fact that they just simply couldn’t manufacture the one camera that everyone wanted, and that was the PowerShot G7x Mark IIIhot G7X Mark III. The prices for G7X Mark III’s out here in Asia were wild last year, with the retail price going for 150 to 200% more than the camera was originally sold for.

=====

With the caveat that my knowledge of the intricacies of high finance is substantially less than, say, quantum mechanics,, when Canon exited these two markets, well, I've made my points here previously, and I believe that recent actions on the part of Canon's decision-makers have indicated some awareness on their part that maybe there were errors made.

Here's why (again).

My wife and I visited the USA's east coast alone in early December '25, visited with family and the Chicago area over the holidays, and the two of us returned from the USA's west coast last night.

Let's just say a modest selection of Canon's M series of bodies (two) and lenses (three) served us well, a selection small enough to fill a bit more than half of a smallish backpack, a backpack that easily fits underneath an airline seat.

A decade or so ago (maybe longer), Canon's S95 was also in my pocket for our travel photos and everyday photos.

That S95 still works, but does not travel any more, and has been supplanted in one (or both) of the following ways (depending on needs):

(a) the M200 with either the EF-M 22 or EF-M 15-45 lenses

(b) the iPhone 12 Pro Max

My credit card is ready-and-waiting for a size/mass/volume replacement for the S95, a replacement that has as much technology that Canon can fit into a tiny body, technology that will enable acquisition of images superior to that of my trusty iPhone (used for the image below):

A part of my photo motto is "Pick the right tool for the job".

I want another tool. I would prefer it be Canon.

Canon is ‘gone’ from the Japan P&S market Top 3, where they used to have a solid place (along with Sony, with whom they traded back and forth for the #1 spot, and who is now also ‘gone’ from the Japan P&S market Top 3 just like Canon.

It's a safe bet that Canon will release a photocentric PowerShot with their new 1.4" sensor. They didn't create a new sensor and new sensor size for just one camera.

I suspect that Canon considered the fixed-lens compact camera market to be dead, and belatedly discovered otherwise.

Speaking of Sony, they recently agreed to sell a majority stake of their tv business to TCL. If they ever decide to do the same with their camera business, it seems that DJI might be a good fit.