We heard a lot (a LOT!) of people defending percieved high Canon pricing, saying it is due to the run up in the value of the Yen that ended in 2011. Sometimes this was said with the kind of absolute certainty that can only come from someone with no training in a subject.

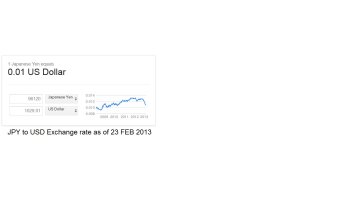

Now Japan is printing money to achieve 2% inflation in their economy, and the Yen is plunging as a result. See http://www.bbc.co.uk/news/business-21468587

Question: If the High Yen = High Canon Prices argument was as valid as was asserted so many times, will we now expect to see this effect working in reverse? Or will prices stay the same, and the True Believers simply latch onto some other factor to explain it?

Now Japan is printing money to achieve 2% inflation in their economy, and the Yen is plunging as a result. See http://www.bbc.co.uk/news/business-21468587

Question: If the High Yen = High Canon Prices argument was as valid as was asserted so many times, will we now expect to see this effect working in reverse? Or will prices stay the same, and the True Believers simply latch onto some other factor to explain it?