When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. |

BCN is a top retail sales data aggregation company for the Japanese market. It gives us an excellent idea of what and who sells in Japan. I would imagine that BCN, outside of China's sales data, probably drives a lot of what Japanese companies do regarding products.

So why do you care? The companies near and dear to our little hearts are Japanese-based companies. They have a strong sense of tradition and pride in the Japanese market. Also, the Japanese market usually allows us to see trends early. As trends start to happen in Japan, we see these trends ripple out to other regions afterward.

It should be noted that BCN is simply units sold. Lower-cost cameras tend to sell in more volume than higher-cost items, so the data can be a bit disproportionate when it comes to total value market share.

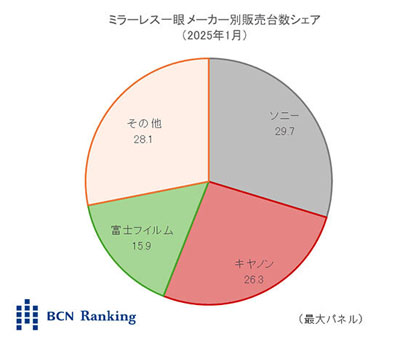

According to BCN, Sony continues to sell very well in Japan and controls the market with 29.7% of retail sales; Canon is second with 26.3% of the market share.

In the above graph, grey is Sony (29.7%), red is Canon (26.3%), and green is Fujifilm (15.9%). The rest of the market is represented by pink (28.1%)

The Canon EOS R50 was the top-selling camera in Japan for January 2025, but Canon was fairly quiet in the top 10, only having the EOS R10 and EOS R50.

Fujifilm continues to do well with the X-M5, which also caused Fujifilm to move into the number 3rd overall position for the first time since last August, overtaking Nikon by gaining 4.6% over the prior month.

Nikon continues to struggle somewhat with sales, and for the life of me, I have no idea why that is. I know Nikonians will state that Nikon isn't chasing the volume and market share, but that's a bad way of doing things. Mount market share is essential, especially when you want to attract third-party manufacturers to make stuff for your cameras. It is usually a good indicator of how active the used market is and, as well, simply your presence in the market.

The top cameras in Japan for January 2025 are;

- Canon EOS R50

- Sony VLOGCAM ZV-E10 II

- Fujifilm X-M5

- Sony VLOGCAM ZV-E10 II

- Sony A6400

- Canon EOS R10

- Olympus Pen E-P7

- Nikon Zfc

- Sony A7C II

- Panasonic Lumix G1000

I know the sharp-eyed ones out there will notice the PEN E-P7 on the list. That usually happens when a company dumps a camera onto the market at large discounts and also with multi-lens kits. Those tend to distort the market a bit, as they are volume sellers in Japan.

When you don’t have it, for some it’s a mental balm to say that you don’t want it.

Nikon did have it…and lost it.

for reals. for reasons really unknown to me. their cameras seem top notch even from the initial Z entries, good sensors, great lenses. even came out with APS-C before Canon did.

Smarter people then me probably know why I guess.

Edit: did they mess up the legacy F-mount compatability? I can't recall.

According to Ken Rockwell, the Z mount adapters seem compatible with most of their old lens types: https://kenrockwell.com/nikon/mirrorless/lenses/ftz.htm

Sony manufactured the sensor’s for Nikon’s recent DSLR’s, I guess that made jumping to Sony mirrorless camera’s easier for Nikon owners.

It's funny how when people talk about market share and why some companies are doing well and others struggling, few people mention the main factor today in buying decisions, and that is the internet, social media and YouTube reviewers and influencers. Some of the top influencers mocked Nikon for years. Others, especially 5-10 years ago, sang Sony's praises to the roof (even thought their first 2 generations of cameras were crap). Guess who rose and guess who fell?

IMO, it was Nikon's failed initial attempt at MILCs. Sony led the way (running away from CaNikon's dominance of the much larger DSLR market). The Nikon 1 system had some nice aspects (I still regret not buying the AW 1 and the waterproof lenses) but the 1" sensor killed it. Canon succeeded like gangbusters with the M series, which became the most popular MILC line globally and assured their continued market domination as the industry transitioned to mirrorless. Nikon missed the boat, and once they started with 'real' APS-C and FF MILCs, they were already bleeding market share to the point that recovery is a long road (so long they may never regain their long-time #2 market position).

You are probably right about the influence of the Youtube “experts”, @neuroanatomist is right about Canon’s success with the M-series.

This doesn't really seem like a fair assesment of Nikon's market share. BCN sales data fluctuates wildly from month to month depending on the latest releases. They were up to over 17% market share in June 2024. A better view is where they end up for the entire year. You previously wrote an article about the 2024 BCN data for the entire year titled: "BCN Awards 2025: Sony and Nikon make Significant Gains in Japan"

Seems odd to say Nikon has made gains over the entire year of 2024 and then knock them on market share a month later.

In their financial reports Canon went from 2.88M DILC's sold in 2023 down to 2.84M DILC's sold in 2024 for a -1% growth rate. Meanwhile Nikon went from 700k DILC's sold in 2023 to 800k DIlC's sold in 2024 for a 14% growth rate. Nikon's market share increase for 2024 was the most of the big 3.

Not that DSLR's matter much these days but they also grew their market share by almost 4% while Canon lost almost 8%.

Canon's camera revenue grew 6.5% while Nikon's camera revenue grew 10.8%.

Canon is clearly leading the market but what more do you want from Nikon? They grew their market share in terms of both units sold and revenue more than Canon did.

I guess the entire overall thought on that escaped you. So let's deal with it.

Both Nikon and Canon had huge installed DSLR bases, and 10's of millions of legacy DSLR lenses. Canon stumbled with the RP and R and really didn't get going until the R5 and R6 models came out - almost 2 years after they released the RF mount.

Meanwhile, both of nikon's lenses the Z6 and Z7 were objectively far far better than the RP and R, and included IBIS. Nikon even released their APS-C Z mount camera, again before Canon.

All said, Nikon did more, and did it quicker than Canon, but failed to execute the pivot in terms of keeping their marketshare.

That really wasn't that hard to get from my commentary on Nikon. it has nothing to do with the last quarter. Nikon is a distant third to Canon and Sony, and may even fall to a forth position if Fuji has a strong year. This is down from the DSLR days when Canon and Nikon would be neck and neck in marketshare for a significant period of time, and push each other to come up with better cameras and lenses.

also: 14% of nothing is still nothing.

“Great job, Nikon!” *pats Nikon on the head* “You barely managed to hang on to 3rd place in the race, but your time was 14% faster than last week, and the first place kid was 1% slower than last week, so you’re the real winner!! Here’s your participation trophy…”

It's not like it's a new race that restarts each year.

On the other hand, Canon didn't suffer from it, maybe because they had, thanks to important and popular innovations (AF, OIS and video- able stills cameras), acquired a strong reputation. Despite the temporary lack of Milfs, they managed not only to survive, but to thrive.

PS: My own experience with Sony was also atrocious. Menus, colors, ergonomics, quality, EVF, lack of top LCD, mechanical quality of lenses, size of body.

To put it in a nutshell: almost everything about the A7 (?) was a nightmare. 2 weeks later, I sold it and bought my 5 D III with the 24 TSE and the 100-400 L II.

And have been happy since... 🙂

How is 14% growth in a single year nothing? Keep in mind the per CIPA the DILC market as a whole grew by 10%. So Nikon outperformed the market a bit while Canon severly underperformed it.

This is a good analyogy of what I see happened. Canon sold 400k less while Nikon sold 100k more so they got closer by 500k. And that is in a year when Canon released the outstanding R5mII and the long awaited R1. I doubt we'll see another year where the difference between the 2 companies is so stark. If that trend were to continue Nikon would be right with Canon in 4 years. Again I don't think that is remotely likely. Nikon will see moderate growth but I highly doubt Canon will be down 400k again next year.

And while I get it were in a team Canon environment market share doesn't translate to revenue. From a revenue standpoint Canon makes about ¥580B from cameras in 2024 and Nikon made ¥293B or little over half. Think about that for a second. Canon sells "3.5 times as many ILCs as Nikon" and yet Nikon still has generates a little over half the revenue. The difference between units and revenue highlights that Canon dominates the low end of the market.

Maybe status quo remains relatively unchanged, point and shoot cameras continue to regain a bit of their popularity and in 10 years were in roughly the same postion. OR maybe the low end of the market continues to get erroded to other tech (smartphones, action cameras, AI, etc) and in 10 years the camera segment is largely high end specialized cameras. Canon seems to be leaning toward the former while Nikon seems to be leaning toward the latter.