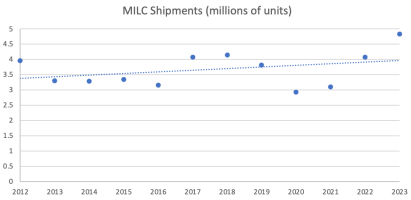

CIPA recently released its final statistics for December, which allows us to now view 2023 in its entirety. For the most part, the industry has reached a state of equilibrium post-COVID-19. There are some interesting a notable trends though, so let’s dive a bit into the details and more importantly, the last 5 years. Looking

See full article...

See full article...