CIPA recently released its final statistics for December, which allows us to now view 2023 in its entirety. For the most part, the industry has reached a state of equilibrium post-COVID-19.

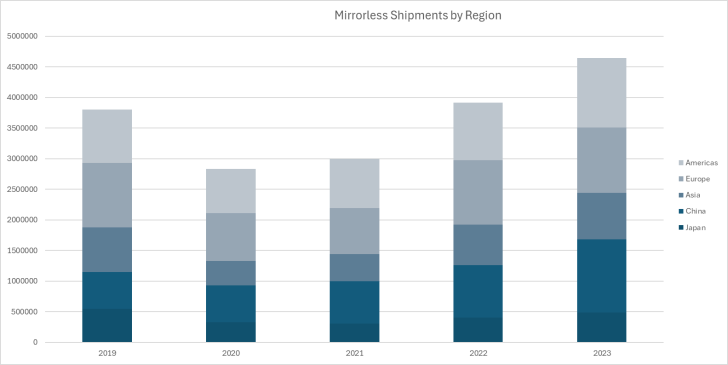

There are some interesting a notable trends though, so let's dive a bit into the details and more importantly, the last 5 years. Looking at the CIPA numbers I think it's safe to assume that the customers that disappeared during COVID simply are not coming back. It's also the year that China has decided to be the top-placing region globally for mirrorless, having nearly 1.2 million units in 2023 shipped into the country.

China has long been an important market for Japanese camera manufacturers, but this is the first year that it's led the way in the market. We can also see that 2023 was finally the year in which Mirrorless rebounded fully and had strong growth over 2019.

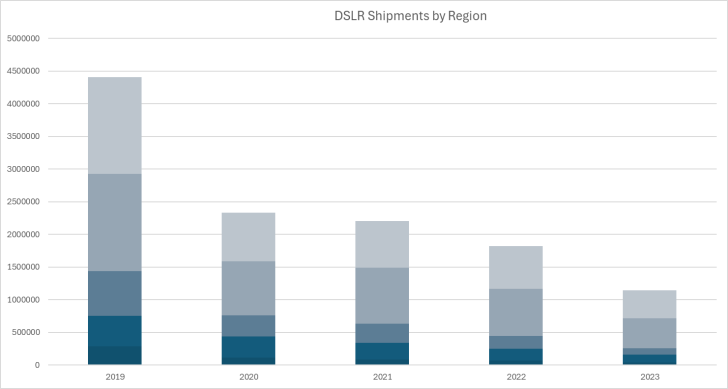

When we look at DSLR numbers over the past 5 years we see why Nikon seems to be retreating from the market as much as possible, and why Canon is discontinuing whatever they can manage. Both Canon and Nikon may have had different ideas, but COVID-19 dropped a grenade into those plans. DSLRs are still shipping in respectable quantities, but only to just the Americas and European markets. Even in those markets, DSLR shipments are just a shadow of past successes.

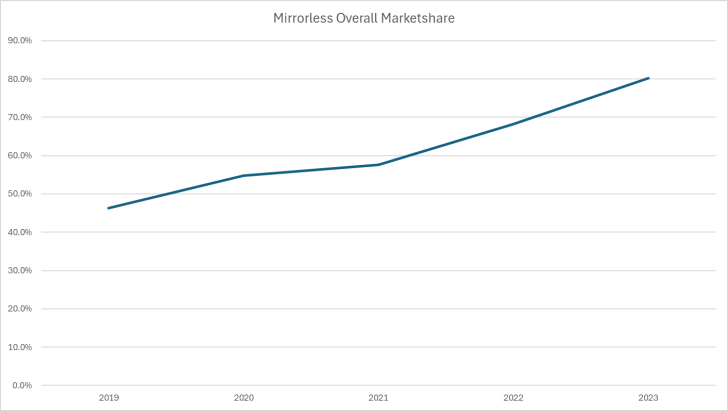

Keeping with that thought, Mirrorless went from being in a competitive race to completely dominating the market in the last 5 years. Mirrorless shipments now are around 80% of all interchangeable lens cameras.

Essentially the full year after both Canon and Nikon released their mirrorless systems, the end was near for those relics with flippy mirrors. I've always been one to think that mirrorless would dominate the market but only when Canon and Nikon deem it so. That seems to hold true to this day.

In all, this was a good year (as we have also seen from Canon's financials – for Canon as well). Let's hope the market continues to rebound after COVID-19 and supply chain issues and that the camera companies continue to reinvent themselves in the current photography landscape.

Of course the market is tanking.

I would have bought a DSLR if either Canon or Nikon would make a new one.

The market might still be shrinking but not by near as much.

MILC is improving since 2020.

Looking forward to 2024 EOS R5 Mark II to replace my 2015 EOS 5Ds R!

Overall, MILC market share has been improving for several years. But MILC unit sales have been essentially flat (on average) since CIPA started tracking them, while DSLR sales plummeted. Note that while unit sales for MILCs has been flat, unit value has been steadily increasing.

It’s too soon to say if the jump to nearly 5 million units in 2023 is an outlier.

Would not be surprised p&s, dSLR & mirrorless will eventually settle at 6 million units annually.

I think a lot of that depends on China for ILC's overall it's the only region with > 20% growth, looking solely at mirrorless, it had almost 40% growth compared to the Americas with 20%. Asia overall contributed the most with 2.44m in shipments, versus 1.92m the year prior.