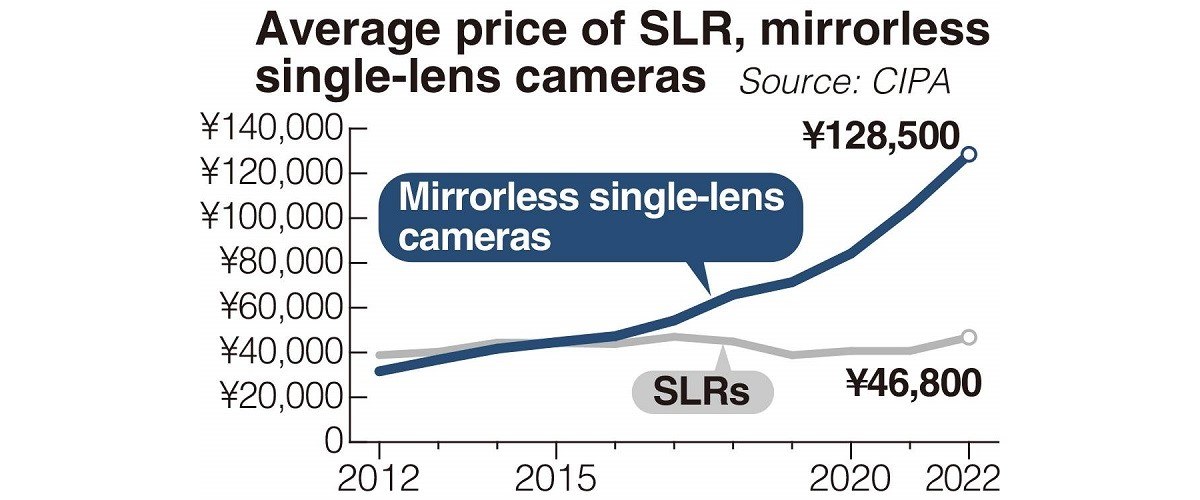

Your overall argument that the bottom of the market is eroding and cameras are moving upmarket is based on your assertion that MILC prices are 'exploding'. That data show that assertion to be false. It was true through 2022, but in 2023 the MILC average unit price fell from its 2022 peak down to ~$800, and it remained flat for 2024. For the first 10 months of 2025, it was ~$750 but factoring in the difference in relative currency adjusts that to...wait for it...$800.

View attachment 227065

"

The next couple months will be telling." LOL, so now you're asserting that even though the average unit price has been flat for the past 34 months, the next two months will prove you right. Really?

But speaking of ignoring things, the topic of this thread is a Sony camera, and about Sony's camera sales you stated, "

A large part of the Sony customer base isn't hobbyist like what you see here. Their base is comprized of content creators and Youtuber's using their cameras to try and make a living." You were asked by

@P-visie to provide data to support that assertion (who, you may notice, provided a source for their own data), and you ignored that request (but proceeded to double down on your previous, failed attempt to support a point with data).

I will repeat my closing line from that previous thread: