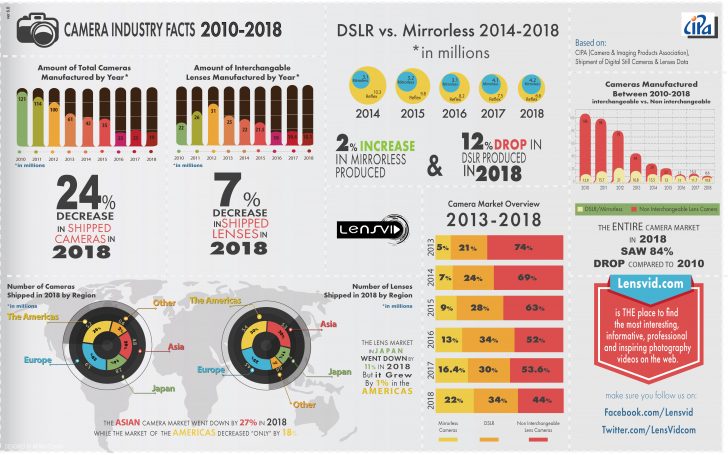

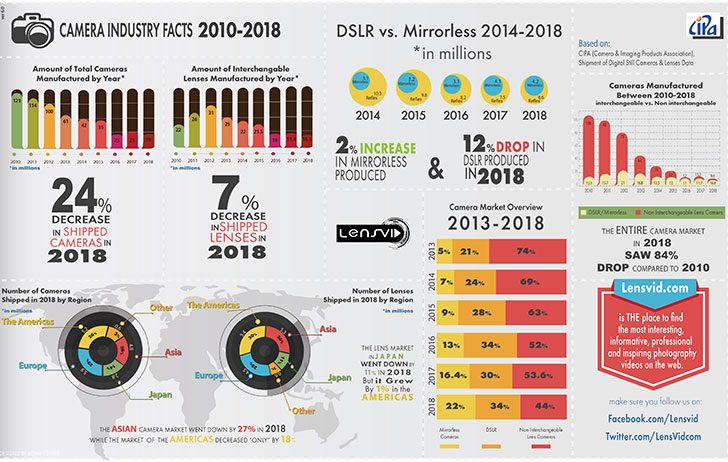

The folks at Lensvid have released their annual “What Happened to the Photography Industry in 2018?” infographic.

It shouldn't be a surprise that camera and lens shipments continued to fall in 2018 by 24% and 7% respectively.

As far as camera sales splits go, DSLRs and mirrorless saw increases of share in 2018, at the expense of compact cameras. Mirrorless only saw a modest 100,000 unit increase in sales in 2018 compared to 2017, while DSLR shipments fell by about a million units.

I think we're nearing the end of the slide and the industry will flatten out in the next year or two, even if Canon thinks we're going to see a further 50% drop in the marketplace.

The EOS R, EOS RP, and all the new RF lenses should help with Canon's sales numbers in 2019, but there doesn't seem to be much in the way of new DSLRs coming, so a further dip in those shipments is likely.

If no new 1D, 5D, 5Ds, 6D or 7D are announced within 17 months then do not expect any further direct DSLR upgrades anymore.

With such a deep decline in sales comes with very limited R&D money for developing new camera bodies, lenses and other accessories. These companies then need to prioritize expenditures for products that will not be eaten into by sibling product lines.

The strong showing of DSLR lens to mirrorless body adapters from Nikon and Canon is another indicator that both companies are focusing all their resources into mirrorless systems.

There is still a market for ILC among professionals and advanced amateurs. Upgrades among pros depends on the budget of their business. Advanced amateurs could be based on a use case or if the gear they have cannot be economically repaired anymore.

Rare would be the user who upgrades to the latest and greatest within 6 months of release because they want their new toys.

Improving economies of scale should be prioritized so the cost of production will not increase and cause a sale price hike. I expect camera makers to consolidate and unify models that are so similar into one. Take for example the Canon Digital Rebel DSLR. BH Photo currently sells 4 unique Digital Rebel models. Canon could consolidate all of them into one model for that product line.

The drop in DSLR sales in far higher than the increased sales in mirroless, thereby they could have cannibalized only a fraction of that. Without knowing which types of DSLR sold less (low-end? High-end? Models in the middle?), it's hard to tell.

Did phones start to eat into low-end DSLR models sales? If so they could hit low-end mirrorless as well. Are customers post-poning upgrades waiting to see how the market configures itself between DSLR and mirrorless models - especially when they have new mounts?

But we do know where the sales are dropping off. It's the low end. All you have to do is read publicly available information.

https://www.sony.net/SonyInfo/IR/library/presen/er/pdf/18q3_sonyspeech.pd

https://global.canon/en/ir/conference/pdf/conf2018e-all.pdf

Why Fuji, Leica, and Pentax are now selling larger than full frame cameras.

Another indicator of the declining of sales of smaller image sensor cameras are how much more full frame lenses are sold than cropped lenses.

Canon CEO noted mirrorless camera sales aren't adding to its bottom line, but are instead eating into the sales of DSLRs. This may very well have played into the reason Canon opted to release only one mirrorless camera in 2018 and doesn't appear to be in a rush to get many more out by the end of 2019. It may have also been a factor in both Canon and Nikon taking so long to get into the full-frame mirrorless market; if all the capital put towards research and development (R&D) is only going to cannibalize your money makers, there's not much need to rush the new technology. - DPREVIEW

Looking at the transition from FD to EF mount, CIPA sales figures of the last 8 years, Canon CEO's January 2019 interview leads me to believe that the window of opportunity of another generation of DSLR refreshes will close by July 2020.

If none appears then expect Nikon & Canon to go all out for their new Z mount and RF mount full frame mirrorless camera systems.